However there are some key differences in the way that Islamic and. Difference between Islamic and conventional banks.

Islamic Banking Windows Islamic Bankers Resource Centre

Meezan Bank Pakistan and bank Islami are taken in the study for the comparison of their performance with two large.

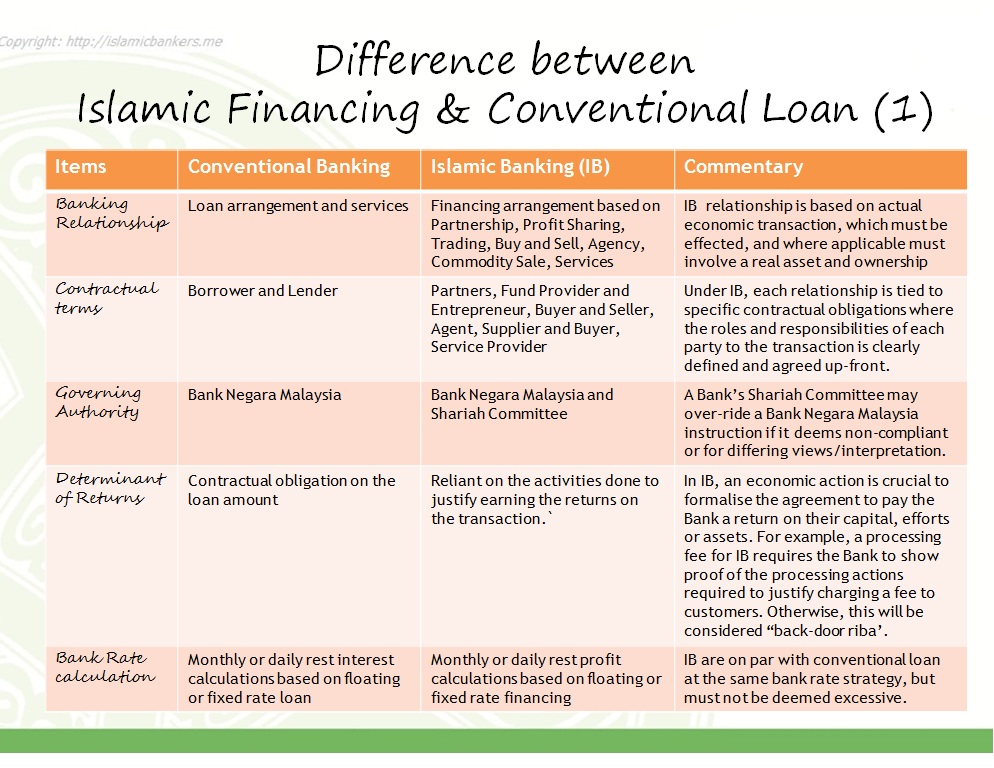

. An introduction to general Islamic banking principles and structures. Relation of customer bank is of Creditor-Debtor. A Comparison of Leverage and Profitability of Islamic and Conventional Bank TOUMI VIVIANI BELKACEM 2011 The researcher through this paper examines the differences between the Islamic and Conventional banking systems with special focus on the leverage and profitability.

The present study is confined to the profitability efficiency and liquidity comparison between two types of banking that is Islamic and conventional banking. This is the first in a series of articles on Islamic finance and banking concepts. Islamic bank are more constantly efficient in their product but still both conventional and Islamic banks did not show significant variation in performance.

Islam is the back bone of interest free banking moral values and objectives play a more important role in its operation. Section 2 provides and entertainment. Hasan and samad 2013 analyse the inter temporal and interbank performance of bank Islamic Malaysia Berhad BIMB in term of profitability liquidity solvency and risk data use from 1884-1997by using ratios through.

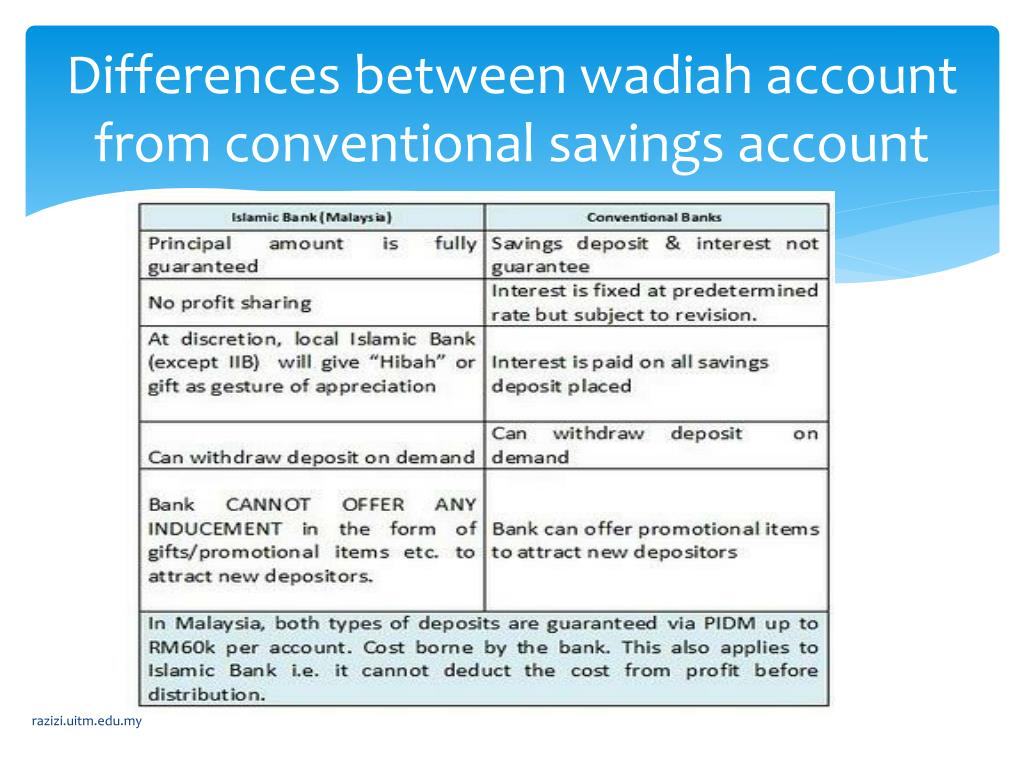

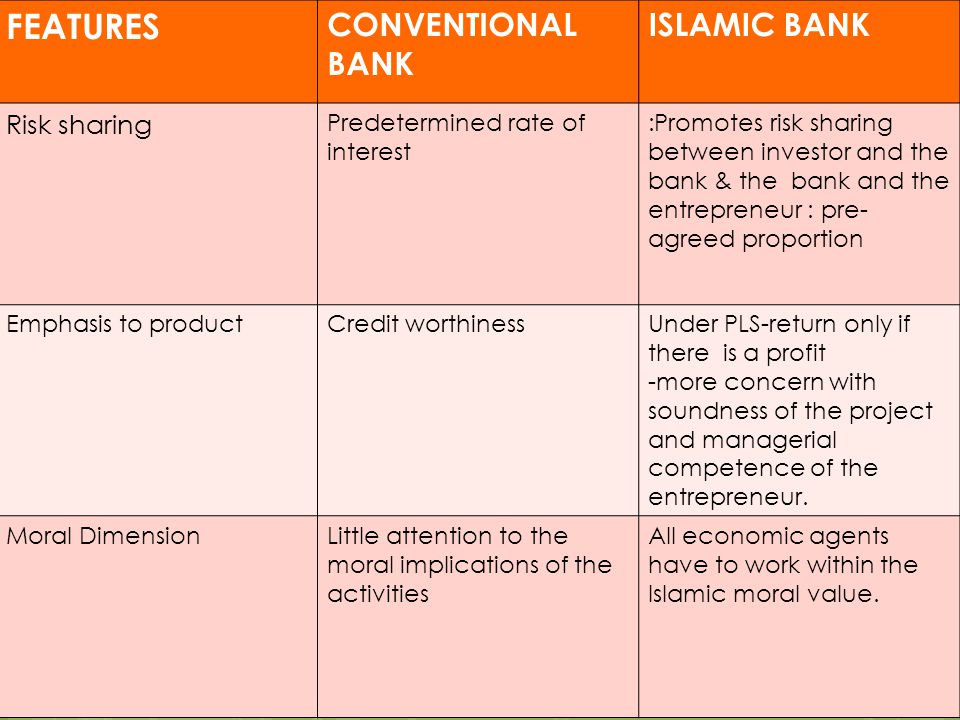

In Islamic Banking on the other hand bank depositors receive their returns depending solely on the banks performance. Based on the Malaysian Islamic Banking Act 1983 Islamic banking is a comprehensive and value-based system that aims to respect and enhance the moral and material wellbeing of individuals and society in general Yahya et al 2012. In the Islamic system money is used only as a medium of exchange.

Section 3 develops the research hypotheses regarding any differences in risk Characteristics of Islamic Banks and the Banking and. The present study. In conventional banks loan and borrow money is based on interest rates.

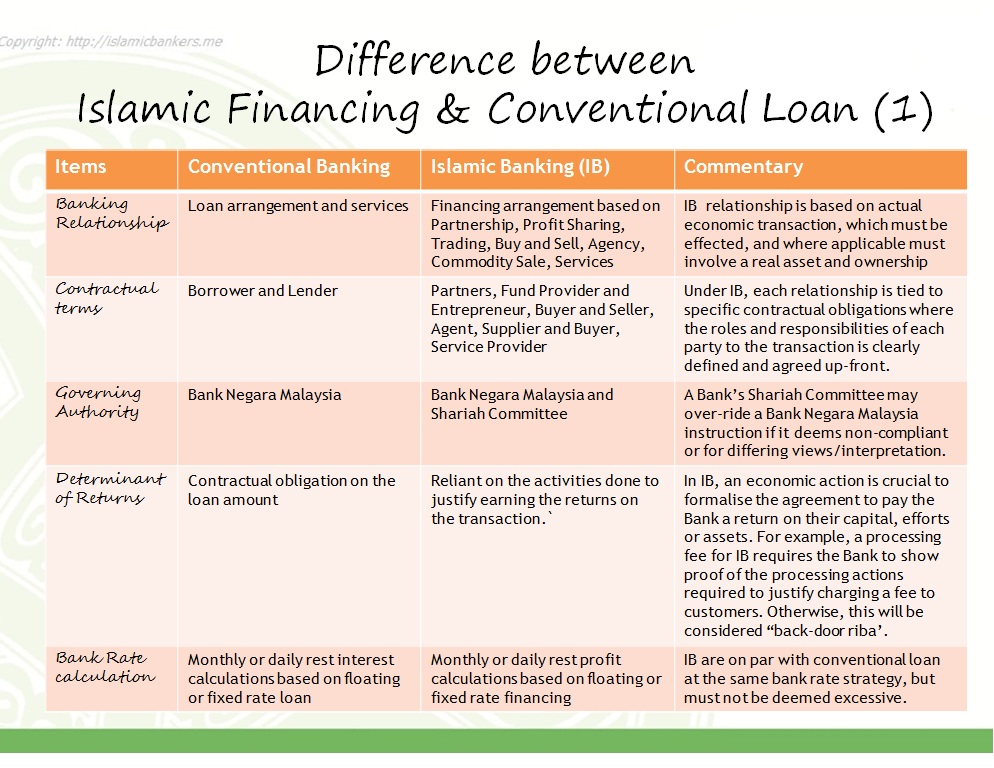

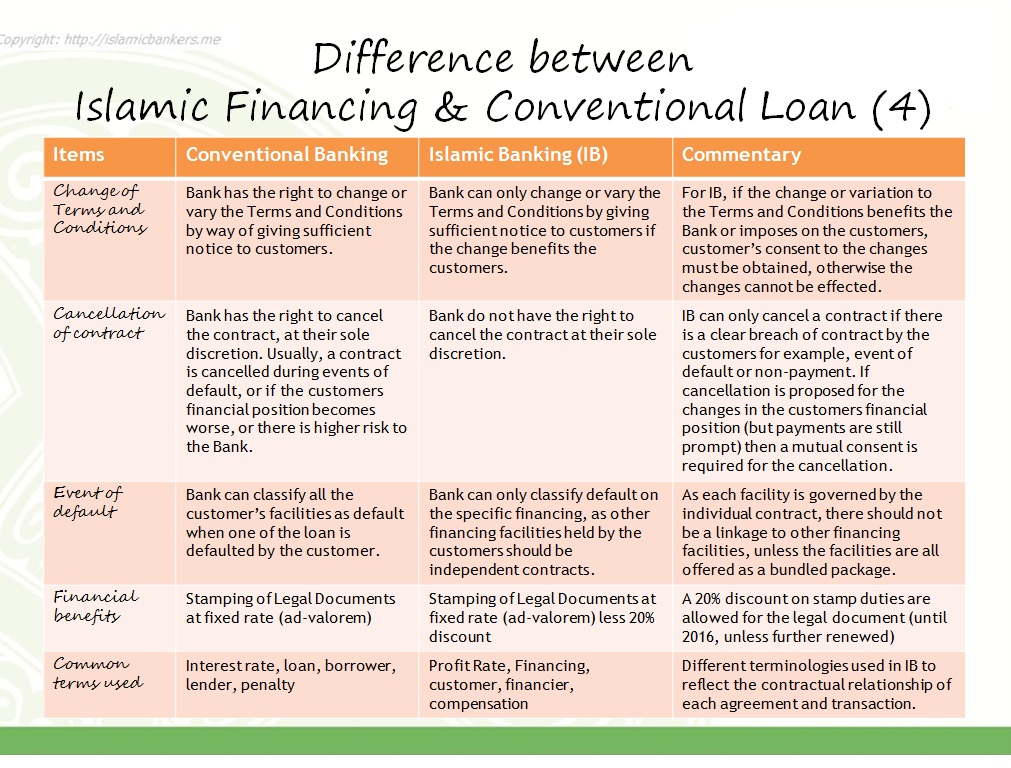

These are the limitations of Islamic banking in Malaysia. The main principle practicing by Islamic banks in their transactional activities is mainly based on profit. Thus all dealing transactions business approach product feature investment focus responsibility are derived from the Shariah law which lead to the significant difference in many part of the operations the conventional banking.

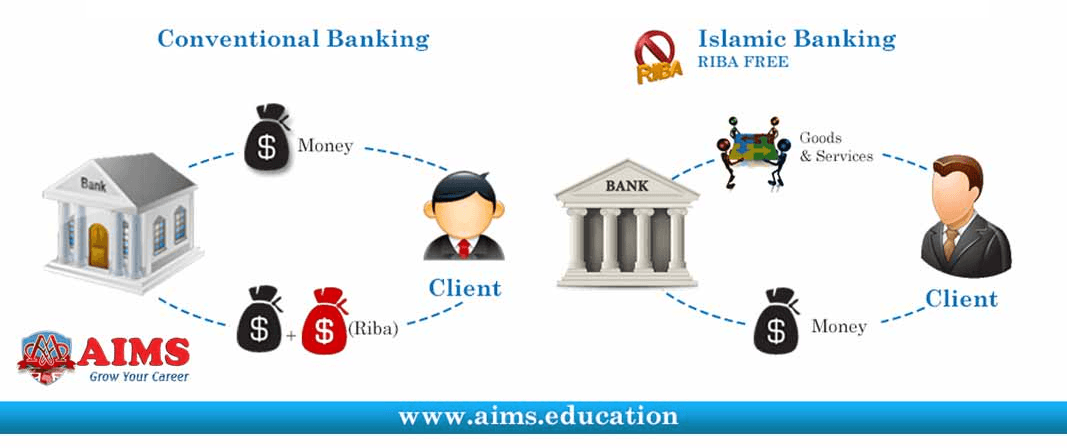

Unlike Conventional Banks an Islamic Bank acts as an intermediary between the depositor and the entrepreneur. Pork related products conventional financial services This study is organized as follows. Conventional Bank treats money as a commodity and lend it against interest as its compensation.

As such Islamic banks declare their profits on a monthly basis as part of their risk sharing scheme. Time is a major factor in calculating the interest charged on the loan capital in the conventional set-up. In general conventional banking principles are fully manmade whereas in Islamic banks principles and rules are based on Islamic Shariah.

Islamic banks provide a trading and investment service rather than lending money. The key contrast is that conventional banks earn their money by charging premuim and expenses for administrarions while Islamic banks acquire their cash by profit and loss sharing exchanging renting charging expenses for administrations rendered and utilizing other sharia contracts of trade. What Is Conventional And Islamic Banking.

There are more legal documents involved for Islamic banking in Malaysia so your legal fees may be significantly higher. Any Islamic finance loan restructuring requires a whole new contract agreement to be created and signed. This is more expensive than conventional loans which only.

There really are differences between Islamic Banking and conventional banking and there are some of us trying very hard to make a difference in the compulsion towards Riba. Both Islamic bank and conventional bank are supervised by central bank Bank Negara Malaysia 2013. Real assets such as land and ornaments are considered as objects of value.

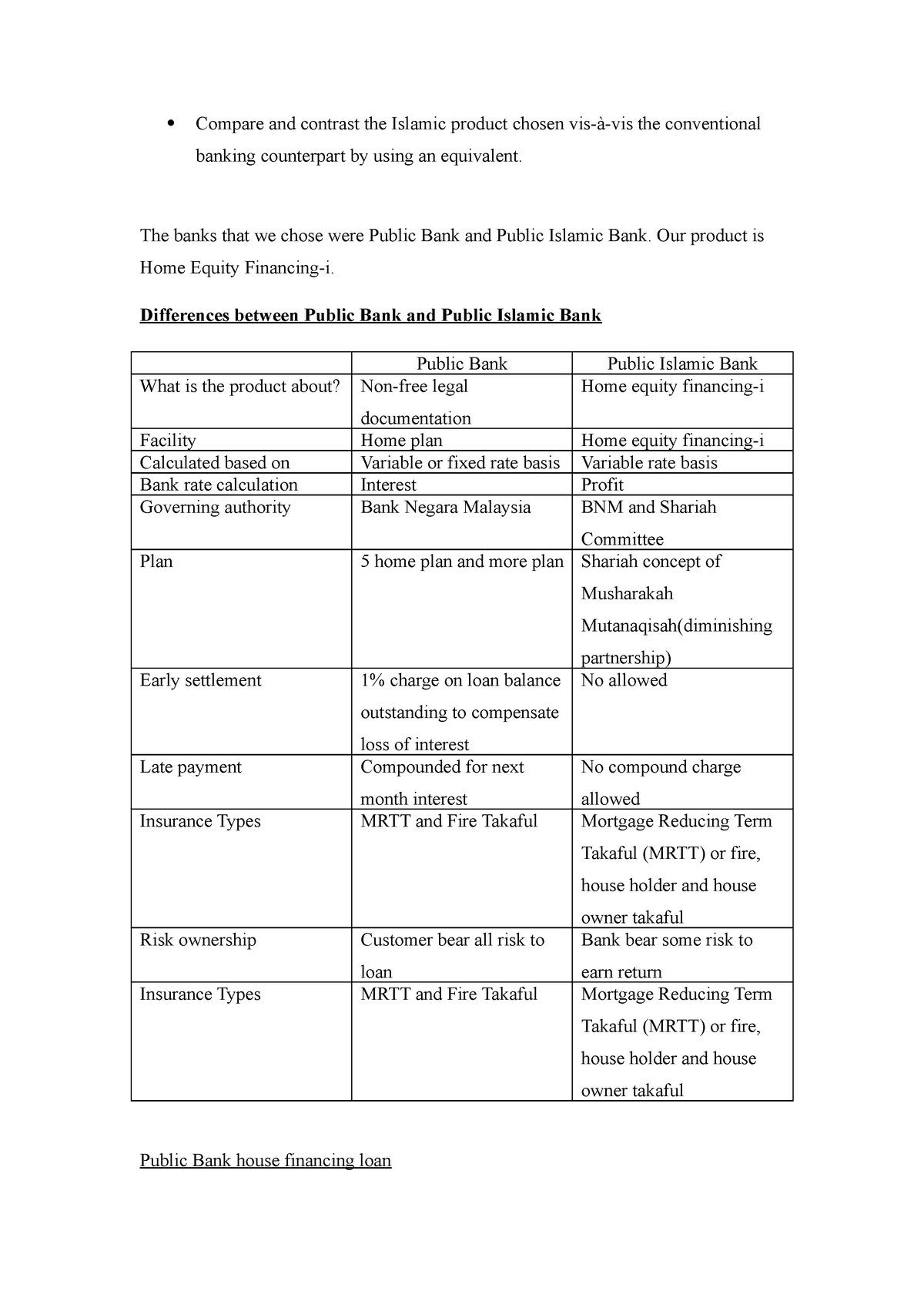

There are a number of key difference between the goods and services existing by a conventional bank in relationship to an Islamic financial organization. Since the introduction of the Islamic Banking Act in 1983 the Islamic BankingFinance system in Malaysia has evolved to be one of the most advanced in the world with path-breaking and innovative products that place them on par with comparable conventional banking products. Relationship of customer bank is of Seller- Buyer and.

Conventional banks are operating is interest in. Unlike Conventional Banks an Islamic Bank acts as an intermediary between the depositor and the entrepreneur. Islamic banking products are usually asset backed and involves trading of assets renting of asset and participation on profit loss basis.

Bank Islam Malaysia Berhad BIMB was the first Islamic bank in Malaysia having been set up on 1 July 1983. DNA OF ISLAMIC BANKS. In Islamic Banking on the other hand bank depositors receive their returns depending solely on the banks performance.

A sample of 545 banks 250 Islamic banks. The main difference is that Islamic Banking is based on Shariah foundation. The overview of the Islamic financial system and the financial system in Malaysia.

The conventional system uses money as a medium of exchange as well as an object of value. As a summary below are some quick differences I have compiled from my earlier days in the industry on the differences between the models. As such Islamic banks declare their profits on a monthly basis as part of their risk sharing scheme.

For this purpose two big Islamic banks ie.

S K Ling Tan Advocates The Fundamentals Of Islamic Banking And Finance

Islamic Banking Windows Islamic Bankers Resource Centre

Pdf Impacts Of The Islamic Financial Services Act 2013 On Investment Account Products Offered By Islamic Banks In Malaysia Semantic Scholar

Ppt Islamic Banking Isb 300 Powerpoint Presentation Free Download Id 1672197

Banks Islamic Bankers Resource Centre

A Comparison Between Malaysia And Indonesia In Islamic Banking Industry Semantic Scholar

The Difference Between Conventional And Islamic Fixed Deposits

Comparison Ib Compare And Contrast The Islamic Product Chosen Vis A Vis The Conventional Banking Studocu

Banks Islamic Bankers Resource Centre

Fundamental Differences Between Islamic And Conventional Banking Download Scientific Diagram

A Comparison Of The Financial Statements Of Conventional Banks Cbs Download Table

Islamic Banking Vs Conventional Banking Aims Uk

Conventional Banking Islamic Bankers Resource Centre

Chapter 2 Framework Of Islamic Financial System Ppt Video Online Download

Some Viewpoints Of Islamic Banking Retail Deposit Products In Malaysia Open Access Journals

Differences Of Components In Balance Sheet Of Islamic And Conventional Download Table

Pdf The Financial Performance Of Islamic Vs Conventional Banks An Empirical Study On The Gcc Mena Region Semantic Scholar

Islamic Vs Conventional Banks In The Gcc Blogs Televisory